Each year, CWSAA and its members compile performance data that shapes the narrative of Western Canada’s ski industry. Primary metrics include skier visits, tax contribution, direct and indirect employment and economic impact, and export revenue that measures incremental spending in a jurisdiction. These numbers form the economic narrative of the ski industry and its contribution to western communities and Provinces and Territories. The data is fundamental to demonstrating to governments the value and scope of the ski industry. The key industry reports are as follows:

- Skier Visits: consolidated report of annual CWSAA skier visits

- Value of Ski Areas Economic Impact Study: a direct and indirect measure of economic impact and contribution of ski areas

- Financial Analysis: detailed metrics of ski area business units for internal benchmarking

- Canadian Ski Council Reports & Research: national studies reporting on consolidated metrics and research from across Canada.

The timing of reports are determined by seasonal cycles, ski area fiscal year-ends, and data analysis. Skier visits are collected at the end of each ski season. Ski area financial data is collected between spring and fall based on ski area year-ends and reported in December to participants. The collective financial data is the backbone of the broader economic impact reports that are completed in the new year, but reports on the preceding winter. For example, the economic impact below reports on the 2021/22 ski season.

2022-23 Skier Visitation (most recent season)

Skier visits are compiled at the end of each winter season. At 10.3 million visits, the 2022/23 season marks the highest number of visits recorded to Western Canadian ski areas. The 2022-23 results build upon the domestic recovery experienced in 2021/22, and strong visitation from the USA. Overseas visits are increasing but have not fully rebounded to pre-pandemic 2018/19 levels.

Skier visits are compiled at the end of each winter season. At 10.3 million visits, the 2022/23 season marks the highest number of visits recorded to Western Canadian ski areas. The 2022-23 results build upon the domestic recovery experienced in 2021/22, and strong visitation from the USA. Overseas visits are increasing but have not fully rebounded to pre-pandemic 2018/19 levels.

Skier visits do not necessarily reflect revenue and financial experience, but they are one of the primary indicators of industry performance. Origin of guest and per capita spend significantly impact the revenues of ski areas and partner businesses within a destination eco-system such as restaurants, accommodators and ancillary activities.

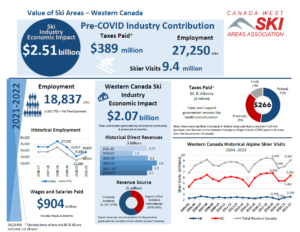

Value of Ski Areas Economic Impact: 2021-22 Report (2 seasons ago)

The 2021/22 ski season experience continued to be heavily influenced by the pandemic. Local and regional demand was strong and there were less operational restrictions compared to the 2020/21 winter.

Visitation to local ski areas was robust. Destination ski areas also benefited from local and regional markets, but lacked destination visitation. Domestic visitation allowed ski area and community business to maintain operations and some local-dependent businesses thrived. Those ski areas reliant on long-haul destination visitors especially from overseas markets still performed below pre-pandemic levels.

Skier visit counts may have rebounded, but revenues were impacted as destination to local visitor spending ratios are approximately 4:1. Ski area and related businesses were also hampered by a severe workforce shortage that in many cases limited operations and revenue centres. This experience is reflected in the 2021/22 economic data that is reported above.

Below are some key highlights from the study.

- $2.1 billion (2021-22) was generated by ski for local and provincial economies

- This represents a 43% increase from 2020/21 season

- Revenues remain 18% lower than pre-pandemic 2018-19 benchmark of $2.51 billion

- 18,837 jobs were created in western Canada in 2021-22

- Jobs increased 22% from the 2020/21 season. However, remain 31% below the 2018/19 pre-COVID benchmark of 27,250

- $266 million was contributed to government (taxes contributed in Alberta & BC)

- This represents a 123% increase from $119 million in 2020/21

- Compared to $389 million in 2018-19.

CWSAA Financial Analysis

Each year CWSAA’s friends at Ecosign Mountain Resort Planners Ltd. prepare the CWSAA Ski Industry Financial Analysis which is based on submissions by ski areas. It provides operators valuable benchmarking by business unit and is only available to participating ski areas. There is no cost to ski areas and each are encouraged to participate and may contact CWSAA for more information.

The collective Financial Analysis data is put through recognized input / output models by Align Consulting to create the “Value of Ski Areas in Western Canada” report (highlights noted above). This presents the full size and impact of the ski industry in Western Canada.

Canadian Ski Council 2022-23 Industry Data

Results from the National Consumer Profile & Satisfaction Research

The Canadian Ski Council(CSC) annual research study continues to show extremely strong interest for snow sports and some potential positive impacts that the pandemic may have on future participation. These insights are derived from the research conducted by the CSC via participation in national programs.

Some of the highlights of the research include:

- 3.155 million Canadians are active snow sports participated (estimated as of winter 21/22). Up from 2.8 million participants in the last full year, which accounts for 8.1% of the population. The CSC expects that this number will grow by another 100,000 people in 22/23, marking the highest participation rate recorded, since 2002.

-

- Active domestic skiers in western Canada have grown from 1.3 million Canadians in 21/22 to 1.36 million in 22/23.

- Overall, skier days is expected to remain at 5.9 per domestic skier on average.

Strong appreciation and intention to continue skiing/snowboarding and recommend it. 100% enjoy skiing/snowboarding. 97% are likely to continue. Net promoter score = 68% up from 64% in 21/22. By comparison, scores for western Canada are the same, save for the Net Promoter Score which tallied 61% in 22/23.

The CSC will be unveiling deeper data and insights in a series of Zoom calls over the coming months. Drop an email to ppinchbeck@skicanada.org to make sure you are on the invitation list.

This information is critical to qualifying our industry for government through recognized metrics, and presenting our industry as an important economic generator and contributor to the social fabric of Canada. The data is vital in supporting every request of government.

For more information on these studies, please contact CWSAA directly. For information on the Canadian Ski Council’s research studies, please contact the Canadian Ski Council.