CWSAA Financial Analysis Report and Value of Ski Resort Areas Economic Impact Report

Published July 2025

Each year, CWSAA and its members compile performance data that defines the narrative of Western Canada’s ski industry. Key metrics include skier visits, tax contributions, direct and indirect employment, economic impact, and export revenue—capturing incremental spending within jurisdictions. These figures illustrate the economic significance of the ski industry and its contribution to communities, provinces, and territories across the west. The data also provides an important tool to demonstrate industry value to government and stakeholders.

The primary industry reports include:

-

Skier Visits: A consolidated total of annual CWSAA skier visits.

-

Value of Ski Areas Economic Impact Study: A measure of the direct and indirect contributions of ski areas.

-

Financial Analysis: A business unit-level snapshot for internal ski area benchmarking.

-

Canadian Ski Council Reports & Research: National metrics and insights from coast to coast.

Data collection and report timing are influenced by seasonal operations, fiscal year-ends, and analysis periods. Skier visit figures are compiled each spring following the ski season. Financial data is collected between summer and fall and shared with participating ski areas in December. This financial data feeds into the broader economic impact study, which was just completed in July 2025 and reflects the winter from two seasons ago (2023/24).

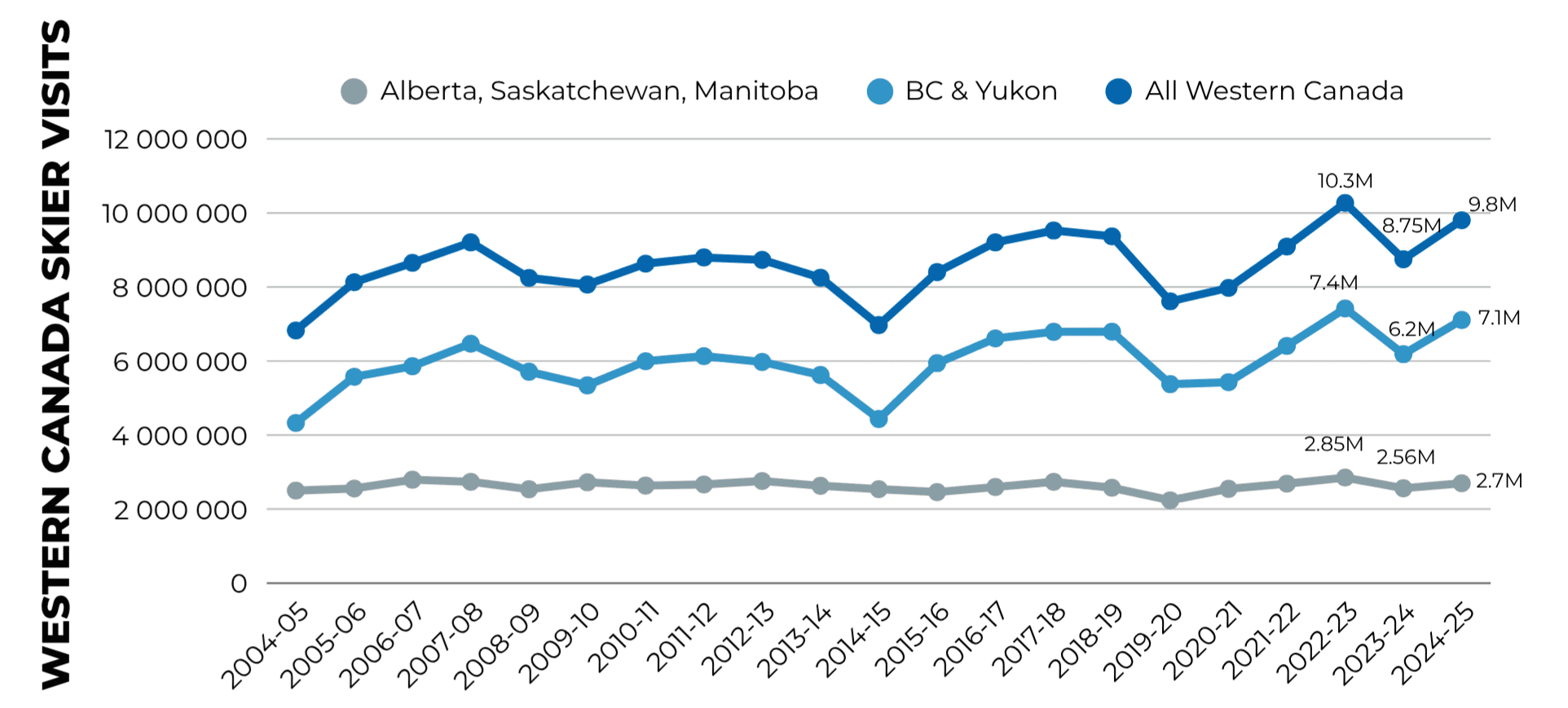

2024/25 Skier Visitation (most recent season)

Skier visits are compiled annually following the winter season. The 2024/25 ski season experienced the second highest visitation on record (next to the 2022-23 season).

Skier visits are compiled annually following the winter season. The 2024/25 ski season experienced the second highest visitation on record (next to the 2022-23 season).

Total skier visits across Western Canada in 2024/25 were 9.8 million, compared to 8.75 million in 2023/24 and the record high of 10.3 million in 2022-23.

- BC-Yukon had a very strong season with 7.1 million visits, which was just shy of the all-time high of 7.4 million in 2022-23.

- ASM skier visits were 2.7 million for the 2024-25 season, which is the fourth highest visitation in the past 15 seasons.

Skier visit totals do not directly correlate to revenues but remain a key indicator of industry health. Destination guest origin and per capita spending levels significantly influence revenue outcomes for both ski areas and surrounding tourism operators.

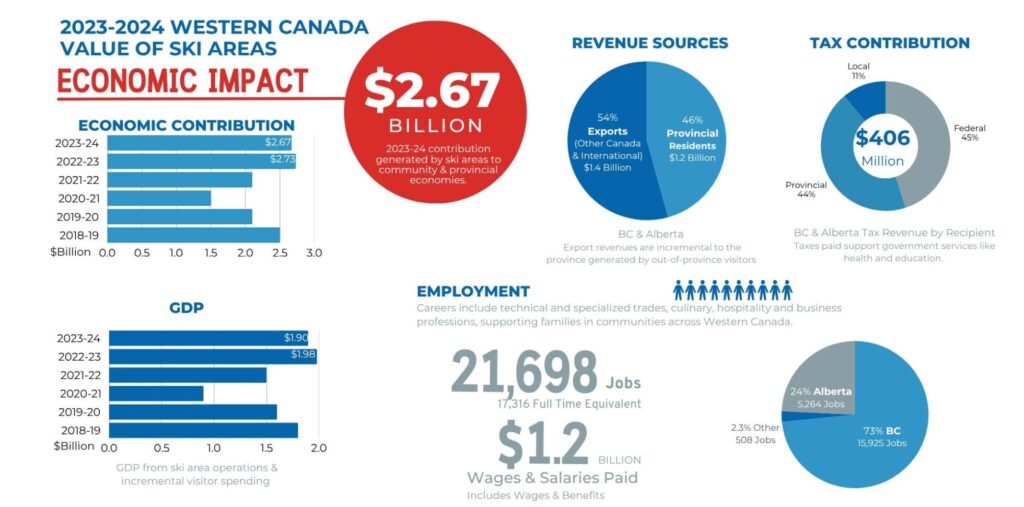

Value of Ski Areas Economic Impact: 2023/24 Report

The 2023/24 economic impact study shows is reflective of a challenging season for snow conditions across much of Western Canada. Despite a decline of skier visits of 15% from the 22/23 to 23/24 season, the change in Economic impact was just 2%.

The 2023/24 economic impact study shows is reflective of a challenging season for snow conditions across much of Western Canada. Despite a decline of skier visits of 15% from the 22/23 to 23/24 season, the change in Economic impact was just 2%.

Key highlights from the most recent analysis include:

-

$2.67 billion in total economic activity generated across Western Canada (compared to 2.73 billion in 2022/23)

-

$2.1 billion from BC ski areas and $493 million from Alberta ski areas

-

-

21,698 jobs supported across western Canada

-

BC: jobs down 1% from 2022/23, down 25% compared to 2018/19 (pre-COVID)

-

Alberta: jobs down 10% from 2022/23, down 3% compared to 2018/19 (pre-COVID)

-

-

$1.9 billion in GDP from ski operations and related visitor spending

These findings reinforce the scale and reach of the ski industry as a tourism and economic driver in Western Canada.

Financial Analysis of Canadian Ski Areas Report

Each year, CWSAA’s partners at Ecosign Mountain Resort Planners Ltd. prepare the CWSAA Financial Analysis of Ski Areas report using data submitted directly from ski areas. This tool provides participants with valuable benchmarking data across a variety of operational business units. Participation is open to all ski areas at no cost, and the report is only available to participating resorts. Ecosign will distribute the survey in early August —interested ski areas can contact CWSAA for details.

This financial data also serves as the basis for the broader economic impact model prepared by Align Consulting. Using established input/output modelling techniques, Align quantifies the direct and indirect value generated by the ski industry across BC, Alberta, and other jurisdictions.

Canadian Ski Council National Industry Data

The Canadian Ski Council (CSC) annual research study continues to show extremely strong interest for snow sports and some potential positive impacts that the pandemic may have on future participation. These insights are derived from the research conducted by the CSC via participation in national programs.

Some of the highlights of the research include:

- The 2024/2025 season saw a rebound 19.5 million Canada-wide skier visits. Up 8.6% from 17.9 million of the prior, weather challenged year. Domestic visits (Canadians skiing and riding in Canada) grew to 17.4 million of the 19.5 million total. BC dominated the growth story for Canada by posting a plus 14.96% year over year change while the return of snow to Ontario and Québec allowed those regions to grow by 9.67% ad 3.83% respectively. BC and Québec continue to own the largest share of the national visit total at 34.5% and 33.4% respectively. Despite this growth, international visits are still some 1 million visits behind pre-pandemic levels. The USA remains the largest international market at 5.9% of visits. Other offshore markets account for 3.2% of total Canadian skier visits.

- An estimated 2.57 million Canadians participated actively (purchased at least one lift ticket) in snow sports (estimated as of winter 24/25). Up from 2.4 million participants in the last full year but still behind the record 2.8 million active Canadians of the year 2022/23.

There is a strong appreciation and intention to continue skiing/snowboarding and recommend it – 99% enjoy skiing/snowboarding; 97% are likely to continue; net promoter score = 66% up from 65% in 23/24.

The CSC will be unveiling deeper data and insights to active program members in a series of online meetings over the coming months. Drop an email to programsupport@skicanada.org to make sure you are on the invitation list.

This information is critical to qualifying our industry for government through recognized metrics, and presenting our industry as an important economic generator and contributor to the social fabric of Canada. The data is vital in supporting every request of government.

For more information on these studies, please contact CWSAA directly. For information on the Canadian Ski Council’s research studies, please contact the Canadian Ski Council.